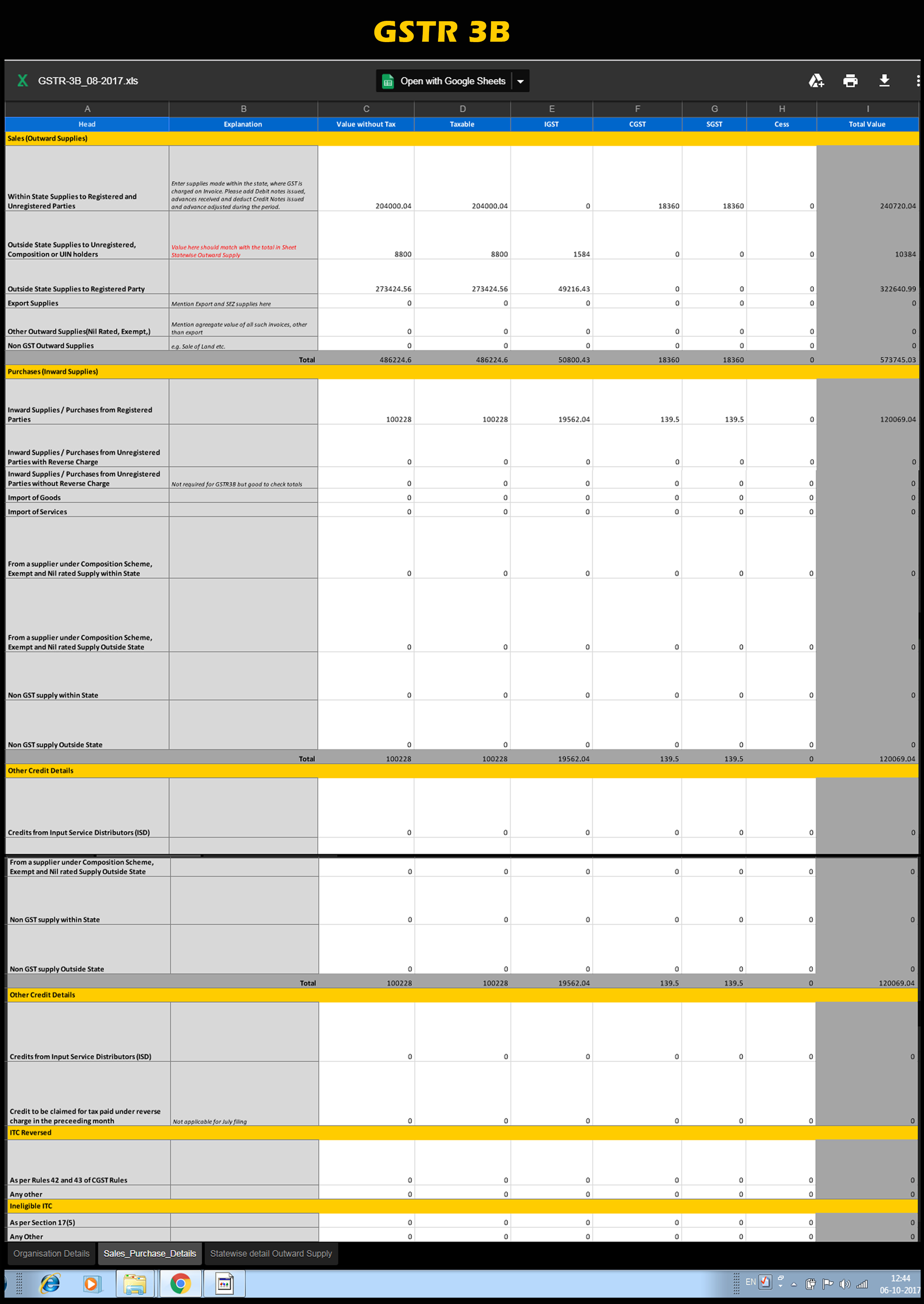

GSTR-3 is a monthly return with the summarized details of sales, purchases, sales during the month along with the amount of GST liability. This return is auto-generated pulling information from GSTR-1 and GSTR-2.

GSTR-3 will show the amount of GST liability for the month. The taxpayer must pay the tax and file the return.

If GSTR-3 return is not filed then the GSTR-1 of the next month cannot be filed. Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

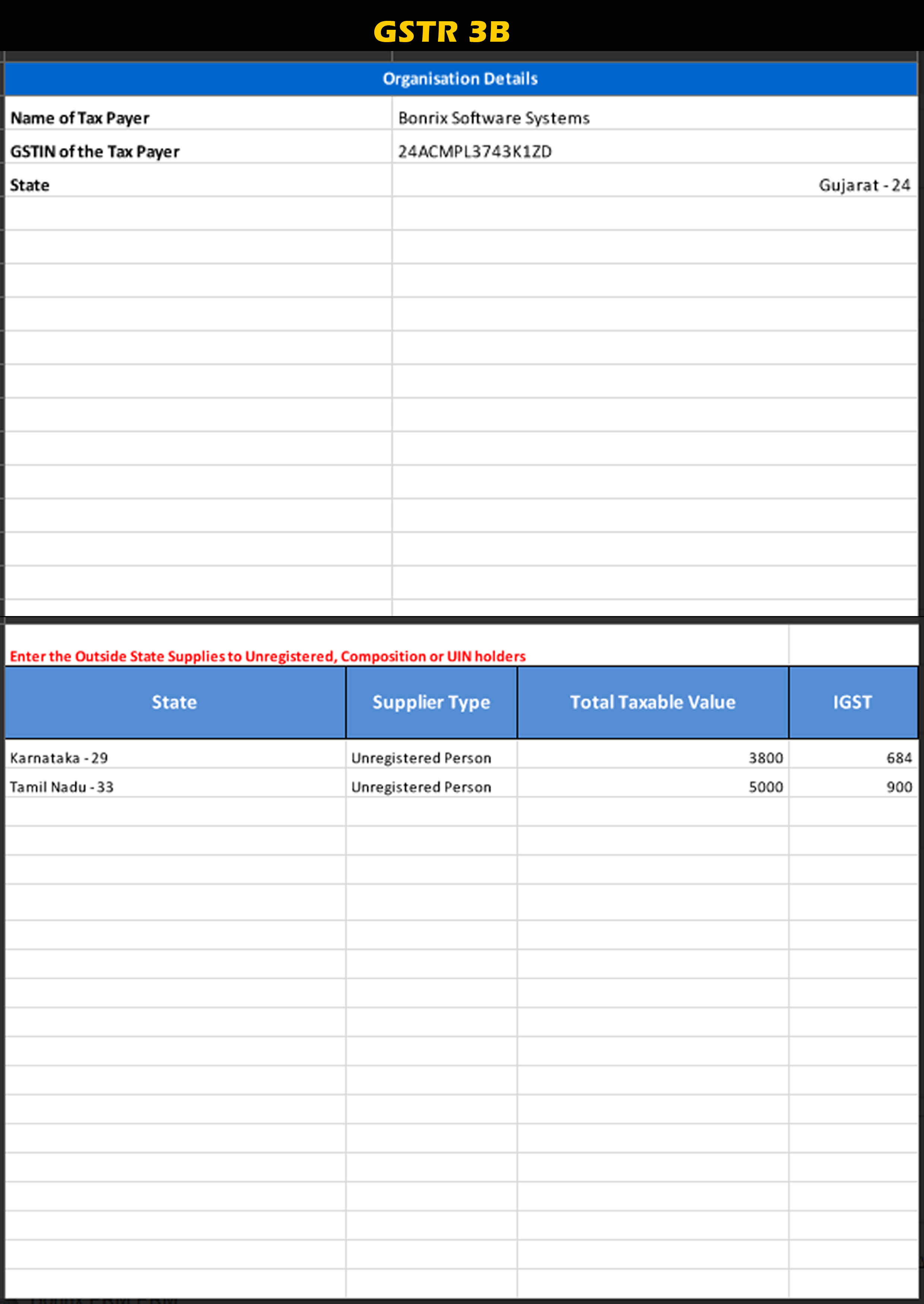

GSTR-3B Xls File Download Download