GSTR -1 is a monthly return that should be filed by every registered dealer.

It contains details of all outward supplies i.e sales.

GSTR -1 contains details of all the sales transactions of a registered dealer for a month.

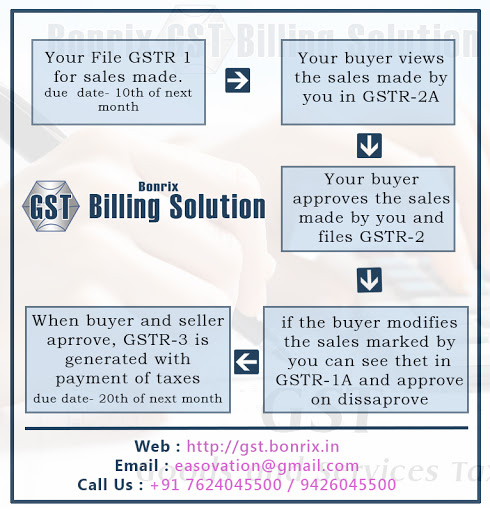

The GSTR -1 filed by a registered dealer is used by the government to auto populate GSTR 3 for the dealer and GSTR 2A for dealers to whom supplies have been made.

GSTR-1 should be filed even if there is nil returns to be filed (no business activity) in the given taxable period.

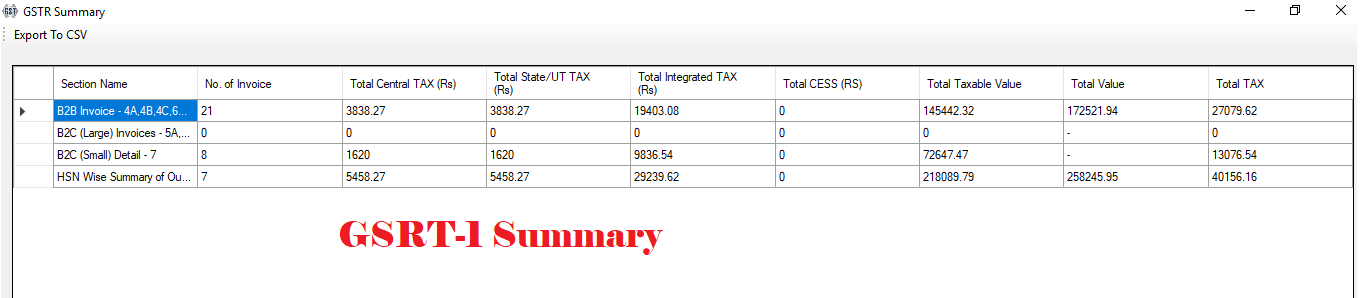

GSTR-1 Summary

Process of filing GSTR 1

- Step 1 : A taxpayer is required to login at GST Portal by using his user ID & Password

- Step 2 : After Successfully login, user can see his dashboard

- Step 3 : Now click on “Service Menu” and then click on Returns and you will reach at GST Return Page. This section shows all the services available on the GST portal. You can select one to proceed further.

- The due date to file GSTR1 is 10th of the succeeding month

- •Forexample- For the month of August, GSTR 1 has to be filed before 10th September

Every registered person is required to file GSTR 1 irrespective of whether there are any transactions during the month or not.

The following registered persons are exempt from filing GSTR 1:

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Tax payer liable to collect TCS

- Tax payer liable to deduct TDS