1.Every registered taxable person is required to give details of Inward Supply,

i.e., purchases for a tax period in GSTR-2.

2. Once the suppliers have filled up their information of sales made during a tax month in Form GSTR-1, it is now the task of recipients to file their receipts of goods or services in Form GSTR-2. This form is a culmination of all the details made by all the suppliers and is available for validation for the recipients.

3. It has to be filed by the 15th of the next month, i.e. 5 days after the filing of GSTR-1.

4.Since the details of the suppliers’ data are already available, this form is auto-populated from such details. The dealers will have to approve or amend the transactions one by one to get input tax credit eligibility.

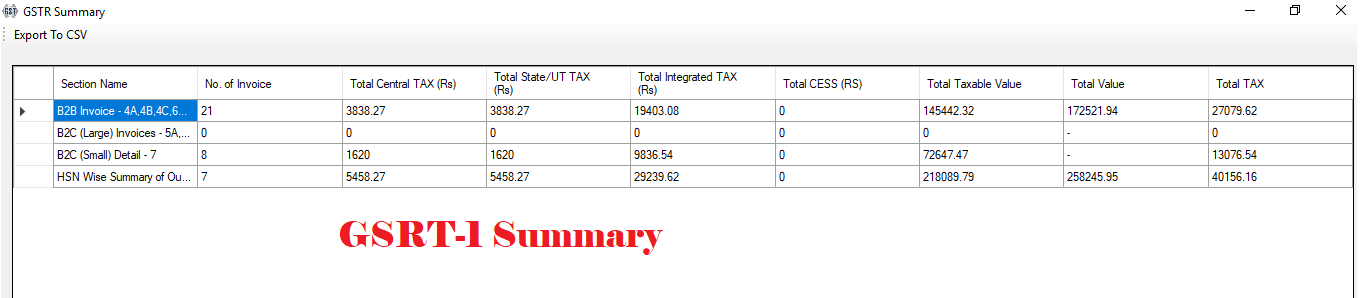

GSTR-1 Summary

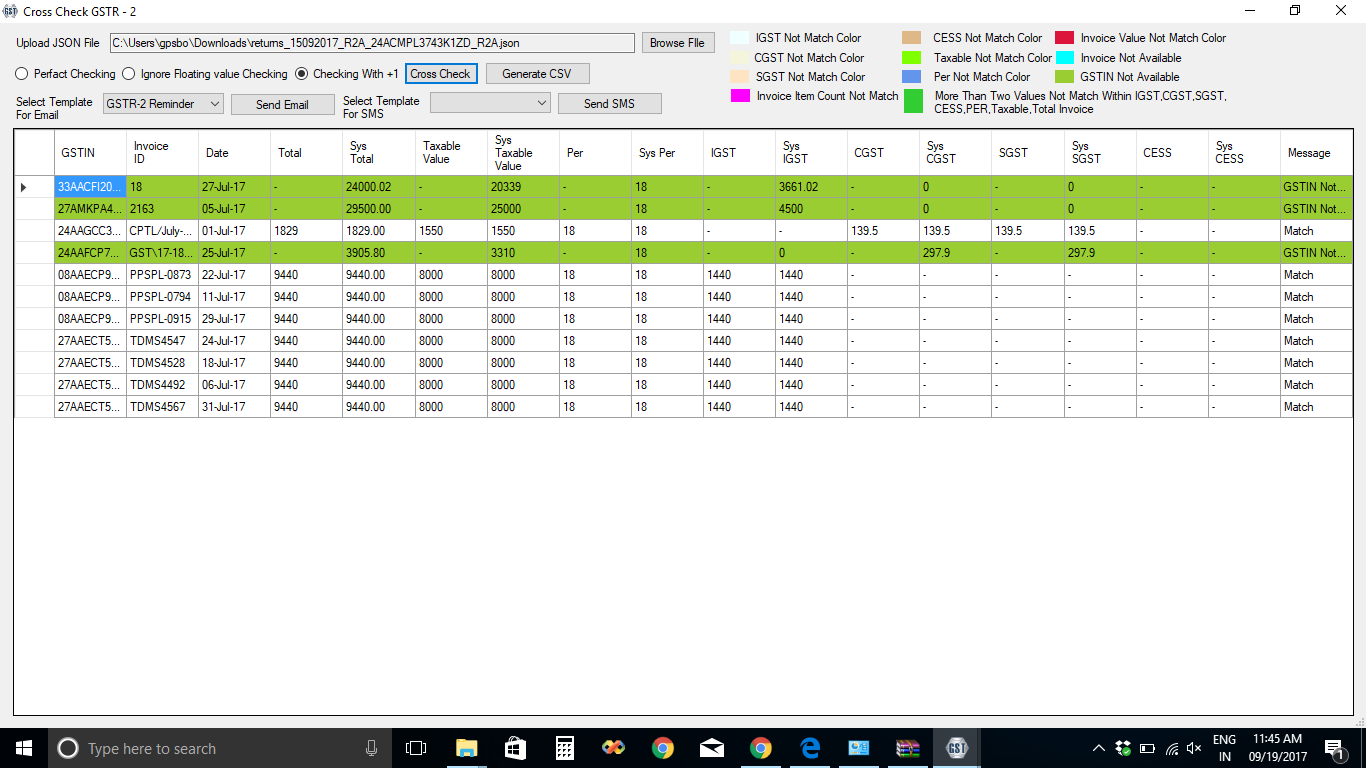

Cross Check GSTR-2

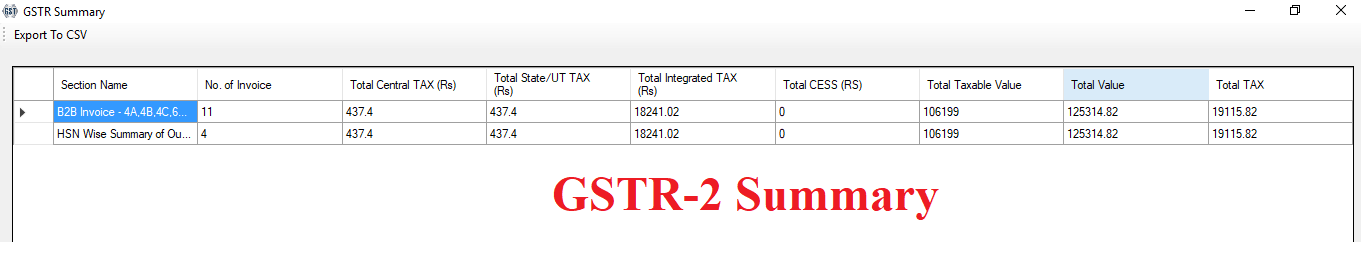

GSTR-2 Summary